For agencies managing a vast array of tools and systems, navigating through scattered data across finance, HR, and media can feel overwhelming and inefficient. Achieving a unified, accessible agency tech stack is critical for streamlining operations, ensuring data consistency, and empowering teams to make data-driven decisions confidently. By creating a single source of truth through agency tech stack integration, agencies can transform their workflows, reduce inefficiencies, and drive profitability.

Benefits of a Single Integrated Platform

Integrating agency tools into one streamlined system provides a wealth of advantages that can significantly enhance overall operations and decision-making processes.

1. Comprehensive Real-Time Insights

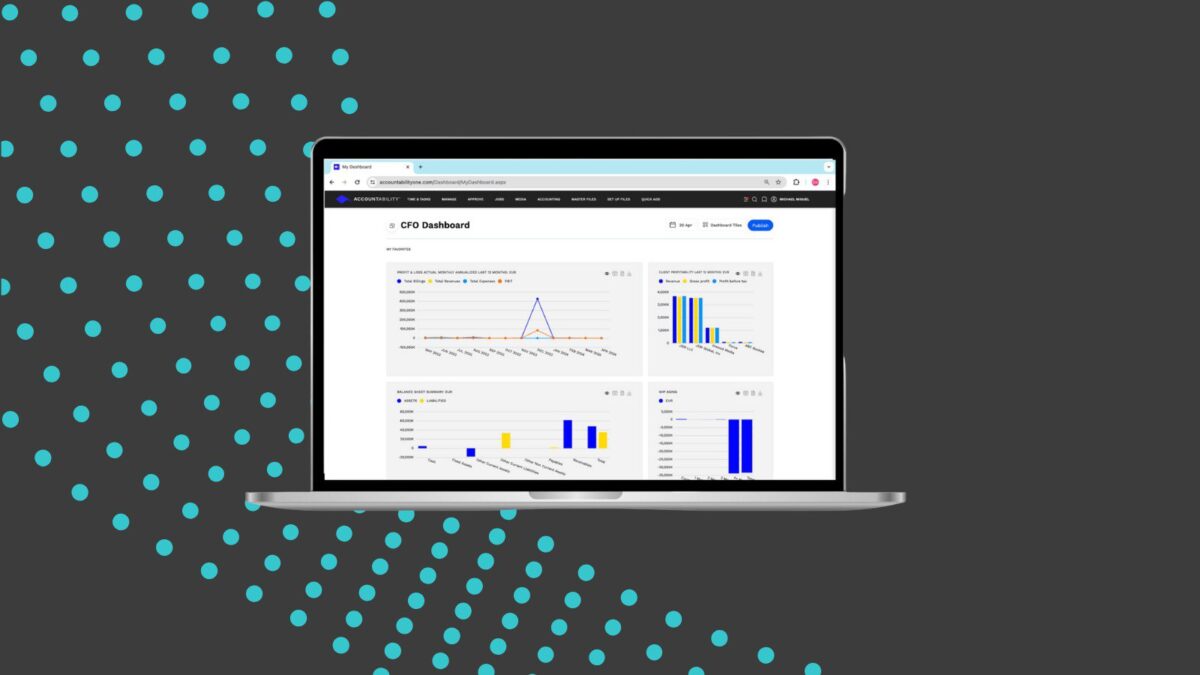

Access to real-time data is essential for agencies to act on the most current information available. With an integrated platform, agencies can consolidate and visualize up-to-date metrics from finance, HR, and project-based data in a single, cohesive view.

Real-time dashboards allow decision-makers to monitor key indicators like financial health, budget adherence, and project progress. This capability supports proactive management, empowering teams to respond swiftly to any issues while fostering accountability and transparency across departments.

2. Reduced Manual Errors and Improved Data Accuracy

Integrating a tech stack eliminates the need for manual data transfers between systems, significantly reducing the risk of errors associated with repetitive data entry. In a disjointed system, discrepancies and inaccuracies can slip through the cracks, potentially leading to costly mistakes.

A centralized platform provides a unified data source that upholds data integrity, allowing agencies to avoid conflicting or duplicated information. Enhanced accuracy supports reliable reporting, analysis, and overall smarter decision-making.

3. Enhanced Collaboration Across Teams

A single source of truth bridges the communication gap between departments. By integrating systems into a unified platform, agencies can ensure consistent, reliable information flow across finance, HR, and project teams. This access eliminates silos, making it easier for all departments to align on shared goals, track progress, and adjust as necessary. A unified tech stack enables seamless information sharing, fostering a collaborative environment where every team member can contribute meaningfully and remain focused on common objectives.

4. Simplified Reporting and Reduced Duplication of Efforts

Reporting becomes more efficient and reliable with a single source of truth, as data from various functions is readily available in one place. Agencies can now generate custom reports quickly without piecing together data from multiple platforms.

With configurable reporting options, teams can access and present detailed insights specific to their clients or projects without duplicating work. This approach enables agency leaders to dedicate less time to administrative tasks and more to strategic analysis, supporting faster, more informed decision-making.

Accountability as the Single Source of Truth for Agencies

When it comes to implementing a unified data solution, a comprehensive platform like Accountability offers an integrated approach that supports alignment across all agency functions, from financials to project tracking. Accountability consolidates crucial data, empowering agencies to operate more cohesively and with enhanced data-driven insights.

A Financial Management Platform Tailored for Marketing and Advertising Agencies

Accountability provides a financial management platform exclusively designed for marketing and advertising agencies. It consolidates core financial operations, including accounting, job management, and time tracking, while seamlessly integrating with leading project management and media tools. This focused approach allows agencies to maintain a centralized financial foundation, optimize workflows, and enhance operational insights without sacrificing flexibility or adopting a one-size-fits-all system. Agencies benefit from tailored implementation, robust training, and ongoing support to maximize efficiency and profitability.

Flexible Reporting Options

Accountability provides configurable reporting tools that meet each agency’s unique requirements, whether for financial overviews, project updates, or campaign metrics. The platform’s tailored reporting capabilities support agencies in responding to specific client needs or project demands with greater flexibility and precision. This adaptability enables agencies to continuously refine their approach based on evolving client or business requirements, ensuring they remain responsive and competitive.

A Path to Alignment, Efficiency, and Profitability

Embracing agency tech stack integration with a single source of truth isn’t just a means of consolidating data. It’s a strategic shift towards more efficient, aligned, and profitable operations. With a unified platform, agencies gain the ability to reduce redundancies, make faster, data-backed decisions, and foster a collaborative environment where accountability and alignment are deeply embedded in the agency’s culture.

As agencies navigate a complex digital landscape, a platform like Accountability equips them with the tools to achieve immediate productivity gains and establish a strong foundation for long-term growth and client satisfaction.

For agencies looking to streamline their operations, enhance collaboration, and elevate their decision-making, Accountability offers a powerful solution. Request a free demo to explore how Accountability can become the single source of truth for your agency’s success.