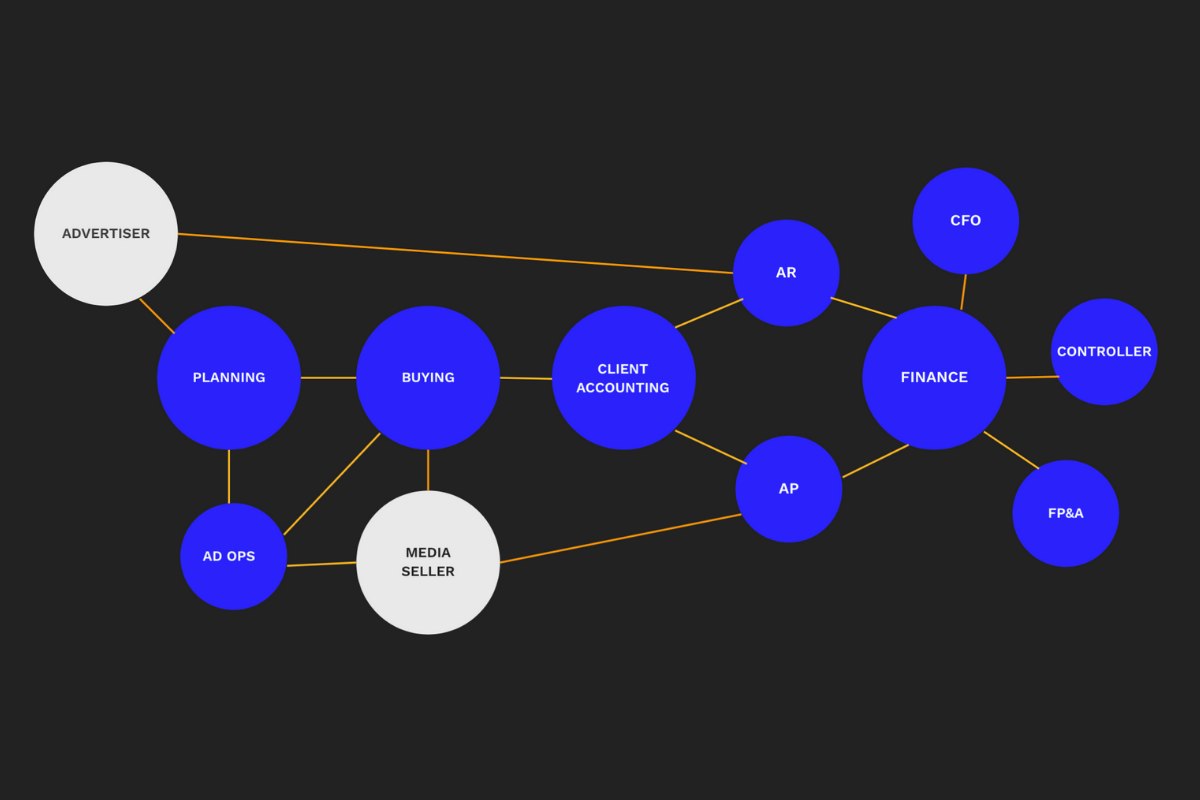

Media buying is both an art and a science. As an art, it requires the best medium to effectively relay a message to the brand’s target audience. Amidst the explosion of content and fragmentation of media channels, choosing a brand-suitable environment is imperative in connecting with that audience. As a science, media buying has expanded from ratings and impression counting to programmatic execution and dynamic targeting. New technologies and an increasingly competitive landscape has made the coalescence of art and science a critical focus for agencies and all players in the media buying ecosystem. Regardless of whether a media buying unit is a stand-alone business or part of a full-service agency, multiple groups are involved in launching an advertiser’s media campaign. In a process that typically requires information hand-off across departments – from planning, buying, client accounting, and finance – there’s a greater risk of things slipping through the cracks and thus affecting the company’s credibility and its bottom line.When it comes to the agency bottom line and financials of media buying , who is accountable? The answer is not as straightforward as it may seem. With each department focused on their specific deliverables, perhaps it’s time to zoom in on the media buying process to help clear things up.

Financial accountability in the media buying workflow

An agency needs to flawlessly execute a brand’s marketing strategy, pitch and win new business, keep up with the latest innovations, all while running a profitable business. Without a communication process in place, something will surely get lost in translation. This requires the front of the house – account leads, planners, and buyers – to communicate effectively and continuously with the back of the house – the finance team. An agency novice might designate the finance team as the sole accountable party for “managing the money.” Let’s work backwards and unpack the media buying workflow debunk this view.

Back of the house

- The AR or Accounts Receivable team ensures that the client is billed for the agency’s work and that the agency gets paid on time.

- The AP or Accounts Payable team is responsible for managing all vendor payments. Whether that’s the media seller, 3rd party technology provider, or data company that the agency used to execute a media campaign, AP’s job is to make sure these parties get paid.

- The CFO is often involved in the “pay when paid” approval process to ensure that cash has been received from the client before disbursing payments to vendors used in a specific campaign.

- A separate Client Accounting team coordinates client billing and vendor invoice management at larger media buying agencies and is the conduit between the back and front of the house.

Front of the house

The buck doesn’t stop with the finance teams.

- How can the AR team know what to invoice the client if the media buyers have not communicated what they’ve purchased?

- How would the AP team know the agency’s vendor liabilities if they don’t see the insertion orders that the media buying team has executed?

The buck doesn’t stop with the media buying team either.

- How does the buyer know how much to spend on digital vs. traditional media channels or the KPIs against specific markets unless the media planner communicates what has been approved by the advertiser?

- How would the AR team know of an incremental budget to be billed to the client in advance of media buys unless the account lead shares the approved amount?

Agency accountability chain

Let’s say that the front of the house and the back of the house are fully coordinated, but the ad operations team did not get creative instruction changes out in time or had missing tags in the ad server. In this scenario, nothing runs and no one gets paid. We can think about this interconnected web of people and processes as the agency accountability chain. One broken link, and the whole thing is compromised. The agency accountability chain starts with the advertiser and is linked to all vendors that have been contracted to execute a media plan. The industry is obsessed with innovations in contextual targeting, reach deduplication, cross-screen engagement, and AI-enabled buying automation. All important and exciting advancements, but proper agency management systems and financial operations are needed to ensure that accelerated growth plans can scale without sacrificing cash flow.

Benefits of a best-of-breed financial management platform

Financial management is the most critical area that Enterprise Resource Planning (ERP) platforms must solve for agencies. A sea of options exists to effectively “follow the money” from plan to pay, but an agency-native ERP specializing in financial management comes with turnkey solutions to scale any media buying operation.

Media platform interoperability

A best-of-breed financial management solution is fluent in the media campaign structure and designed to integrate with best-in-class media buying platforms. It is architected to:

- Capture the most granular level of details from an agency’s media platform of choice

- Have a flexible sub-ledger account mapping to track media costs down to the media type or media group as needed

- Communicate critical financial milestones like cash receipts and payment disbursements back to the media platform to give media stakeholders real-time visibility into their cash position

Flexible organization and master data structure

A best-of-breed financial management solution supports a multi-office and multi-entity agency. It is built with:

- Master data management that is aligned with how media costs need to be dissected and reported back to the advertiser

- Agency-defined fields with customizable lists, so agencies can quickly analyze activities across their organization, track revenue across advertiser industry verticals, and report on spending across a diverse list of suppliers

- Multi-currency and localization capabilities so each office can operate efficiently without sacrificing global reporting requirements

Workflow automation

An agency-native ERP focused on financial management understands that the less time the agency spends on administrative tasks, the more time is spent on high-value activities like strategy and analysis. Operational efficiencies are gained with:

- Automated reconciliation of media costs and billing

- At-a-glance financial summary as soon as the client is billed and a vendor invoice is cleared for payment in the media system

- Access to media transactions without leaving the platform

- Pre-built integrations with automated payment tools

Agency and integration expertise

An ERP platform provider specializing in financial management also serves as the agency’s financial management integration specialist, eliminating 3rd party fees, costly customization and timing dependencies. Just as the agency accountability chain will break if a link is missing, the agency’s advertising technology stack is not complete without a financial management platform built specifically to handle the agency business.

Art + Science + Cash flow is the new media buying equation

The advertising industry is ever-evolving, and innovations around the art and science of media buying will continue to take center stage. However, advancements in media buying cannot fully progress without taking financial operations into account. Art + Science + Cashflow is the new media buying equation, and an integrated media finance platform is foundational in solving it.To learn more, watch Accountability’s Agency Finance Master Class on-demand or request a demo of Accountability’s financial management platform.