Project timelines are shorter. Client demands are higher. Teams are more global, and tech stacks? They’re growing by the quarter.

Agencies have embraced modern tools for project management, time tracking, collaboration, and client delivery. But there’s one system that’s often still stuck in the early 2000s: finance.

If your financial platform feels like the slowest tool in your tech stack, it probably is.

The Agency Tech Evolution (and the Finance Lag)

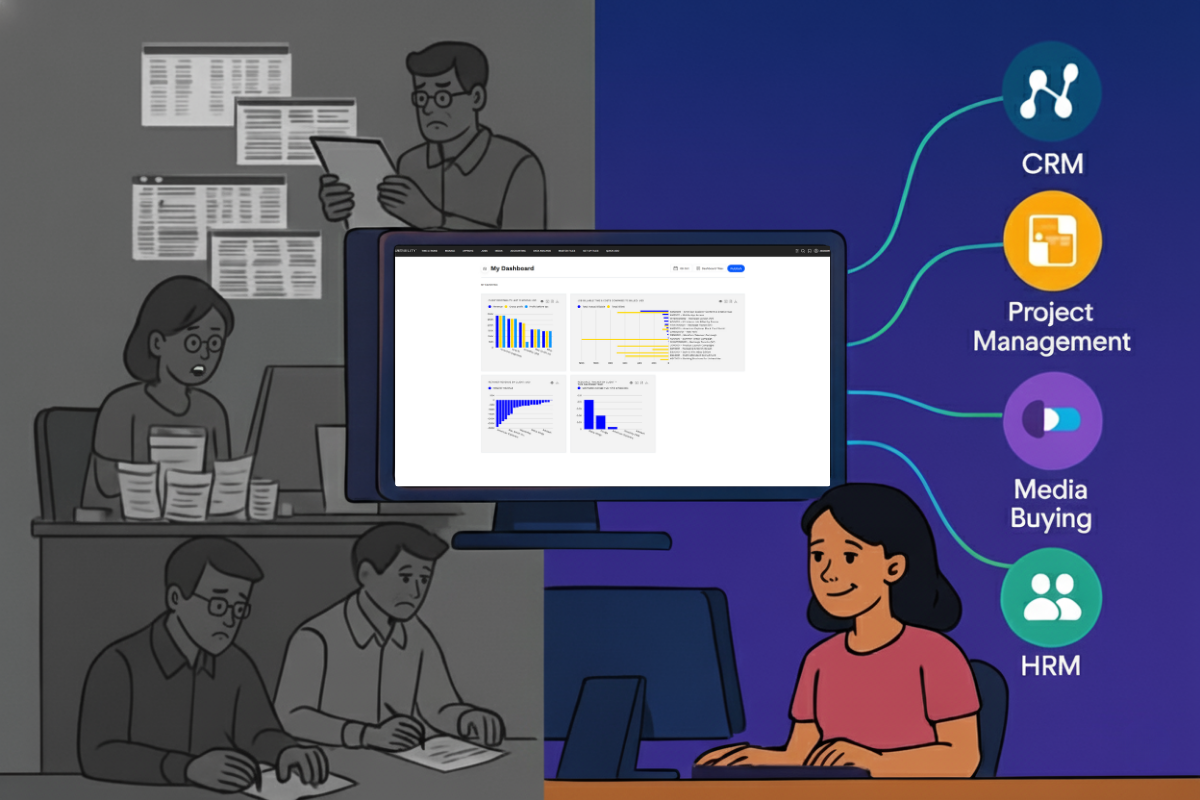

Over the past decade, agencies have adopted best-in-class tools across the board:

- CRM platforms that track deals in real time

- PM tools with live dashboards and team capacity planning

- Time tracking apps that integrate into daily workflows

- Business intelligence platforms that visualize performance

But financial systems? Many agencies are still managing revenue recognition, margin analysis, and invoicing with spreadsheets or rigid legacy ERPs that weren’t built for modern workflows.

The result is a growing disconnect between your finance team and the rest of the business.

What Happens When Finance Falls Behind

- Decision delays: Finance data lags behind live project delivery

- Manual reconciliation: Numbers from CRM, PM, and time tracking need to be stitched together

- Inaccurate forecasting: Sales and ops data don’t flow into financial planning

- Disjointed reporting: Leadership sees fragmented snapshots instead of real-time performance

In short, the rest of the agency is moving at digital speed. Finance is still catching up.

What a Modern Finance Platform Looks Like

To keep up with the pace of today’s agency operations, your financial platform needs to do more than record numbers. It should:

1. Integrate Seamlessly with Your Tech Stack

Your finance system should pull data from your CRM and project management tools automatically—so billing, forecasting, and margin tracking aren’t manual chores.

2. Provide Real-Time Visibility

You shouldn’t need to wait until month-end to understand performance. A modern system gives you real-time dashboards on profitability, resource use, and cash flow.

3. Support Agile, Global Operations

Whether your teams are in one city or across continents, your finance platform should support multi-entity, multi-currency workflows with ease—no spreadsheets required.

4. Enable Automation, Not Workarounds

From billing schedules to revenue recognition to reporting, automation should be built-in, not bolted on.

How Finance Can Lead—Not Lag

Finance leaders are no longer just stewards of the budget—they’re strategic partners. But to lead effectively, they need systems that empower fast decisions, not ones that hold them back.

A modern financial management platform connects the dots between sales, delivery, and revenue—so finance can:

- Identify at-risk clients or projects early

- Forecast with confidence using live operational data

- Automate reporting for leadership and investors

- Spend less time chasing numbers and more time driving strategy

It’s Not Just About Modernizing—It’s About Competing

Your clients expect agility. Your teams expect great tools. If your finance platform can’t keep up with the rest of your stack, it’s not just inefficient—it’s a liability.

Upgrading your financial systems isn’t just a tech decision. It’s a growth strategy.

Is your finance platform still playing catch-up?