In the intricate dance of agency life, the balance between creativity and financial discipline is essential for success. This interplay often shapes the trajectory of innovative projects, demanding a precise blend of vision and pragmatism. What if there was a way to bridge this gap seamlessly? Enter Accountability—a tool that transforms the way agencies handle finance management software, enabling them to innovate freely while maintaining fiscal responsibility.

Imagine a workspace where bold ideas thrive without being overshadowed by financial concerns. Agencies can achieve this ideal by leveraging advanced tools and strategies to navigate the complex terrain of budget management and creative processes. Let’s explore how embracing Accountability fosters a harmonious relationship between creativity and financial discipline.

Balancing Creativity and Financial Discipline

At the heart of every successful agency lies the ability to juggle creative aspirations with practical financial considerations. While the two may seem at odds, they are deeply intertwined, and aligning them can unlock remarkable results.

1) Streamlined Operations Through Integration

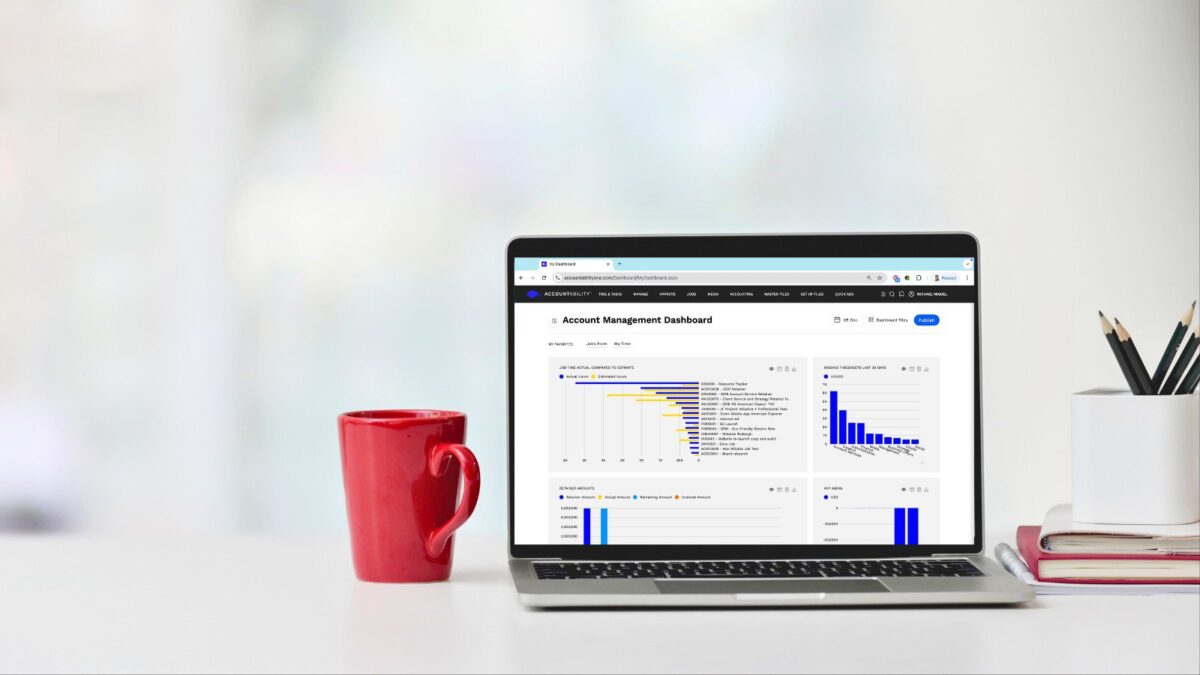

Creativity flourishes in environments where operational inefficiencies are minimized. While project management tools are often the go-to solution, integrating these systems with robust finance management software is a game-changer. Accountability’s platform offers seamless integration of financial oversight with creative workflows, allowing teams to focus on their craft without unnecessary distractions.

Consider an agency managing a complex advertising campaign with tight deadlines. Accountability’s real-time financial tracking ensures that costs remain aligned with budgets, while integrations with AI-driven tools can automate routine tasks like invoice processing. This creates a streamlined environment where teams remain agile and innovative.

Empowering Decision-Making with Data

Financial transparency empowers teams to make informed decisions without compromising creativity. With tools that provide actionable insights, agencies can maintain clarity on budgets while experimenting with bold ideas. This capability helps teams stay within financial boundaries while pushing creative limits.

2) Preventing Budget Overruns with Real-Time Oversight

Budget overruns can derail even the most promising projects, eroding client trust and impacting profitability. Accountability addresses this challenge head-on by offering robust financial tools that emphasize real-time expense tracking.

Early Intervention with Proactive Alerts

An effective system does more than monitor budgets; it anticipates potential issues. Accountability’s finance management software incorporates predictive analytics, alerting teams when expenditures approach critical thresholds. This enables swift course corrections, ensuring projects remain financially viable.

For example, a branding agency working on a high-profile rebranding project can use Accountability’s tools to track labor costs and material expenses daily. If a trend indicates overspending, the system flags it, allowing the agency to reallocate resources or adjust timelines proactively.

3) Enhancing Resource Allocation for Maximum Impact

Efficient resource allocation is the cornerstone of successful agency operations. Whether it’s time, talent, or finances, optimal distribution ensures that each project gets the attention it deserves.

Leveraging Data for Smarter Allocation

Accountability’s time and expense tracking features enable agencies to optimize resource utilization. By analyzing time logs and expense reports, managers can identify bottlenecks and redistribute workloads effectively. This not only prevents burnout but also ensures that creative energy is directed where it matters most.

For instance, an agency developing a digital content campaign can use detailed time tracking to determine which tasks consume the most effort. With this insight, they can allocate additional team members to high-demand areas or invest in automation tools to ease the load, creating a balanced workflow.

Accountability as the Catalyst for Creative Growth

The synergy between creativity and financial discipline doesn’t just happen; it’s cultivated through deliberate practices and the right tools. Accountability bridges this gap, providing agencies with the resources they need to innovate boldly without compromising their financial stability.

By integrating finance management software into their workflows, agencies can achieve new levels of efficiency and control. This translates to more time for creative brainstorming, less stress about budget constraints, and a higher likelihood of delivering projects that exceed expectations.

The Perfect Balance: Creativity Meets Accountability

Financial control doesn’t restrict creativity—it amplifies it. When agencies embrace tools like Accountability, they gain the ability to manage their finances with precision, enabling creative teams to focus on what they do best: producing groundbreaking ideas.

The road to success lies in fostering a culture where innovation and fiscal responsibility coexist harmoniously. Take the first step by exploring how Accountability can transform your operations. Request a free demo today and discover how to achieve the perfect balance between creativity and financial discipline.