Workflow automation is a game-changing solution that not only streamlines operations but also empowers teams to focus on what truly matters—delivering exceptional results. As we delve into the transformative power of workflow automation, prepare to discover how it can redefine your agency’s success, turning chaos into a well-oiled machine.

How Workflow Automation Drives Results

Workflow automation is a strategic approach to enhancing productivity and driving measurable results. By eliminating manual, repetitive tasks, automation frees up valuable time and resources, enabling teams to concentrate on high-impact activities. Agencies that embrace these tools often find themselves better equipped to adapt to market demands, meet tight deadlines, and exceed client expectations. The following sections explore key areas where automation makes a profound difference.

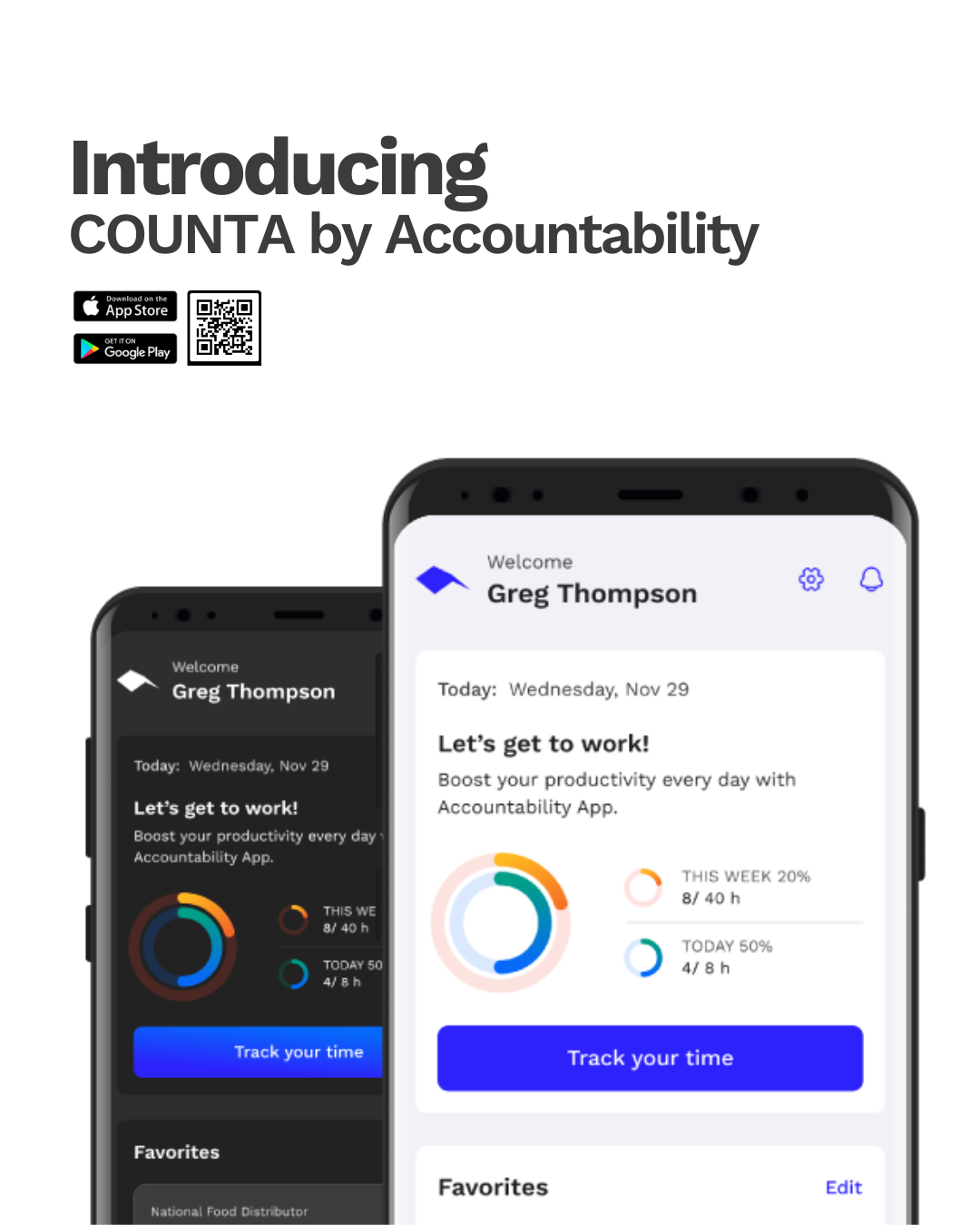

Automated Time Tracking

In the fast-paced world of agency work, accurate time tracking is crucial for productivity and profitability. Workflow automation transforms how teams manage their time, particularly with tools like Accountability that simplify this process. With its user-friendly interface, team members can log hours in real time, ensuring that no minute goes unaccounted for.

Automated time tracking offers several key advantages:

- Real-Time Logging: Employees can record their hours as they work, reducing the risk of forgotten tasks.

- Mobile Accessibility: Designed for on-the-go professionals, time tracking becomes effortless no matter where they are.

- Automated Reminders: Notifications prompt users to log their hours, ensuring compliance and accuracy.

By implementing these solutions, agencies enhance accountability among team members, fostering a culture of responsibility. Real-time data provides management with precise insights for project assessments and billing. This results in a more streamlined workflow that minimizes errors and maximizes efficiency.

Moreover, time-tracking automation helps create better client relationships. Accurate time logs provide transparency when invoicing clients, building trust and ensuring alignment on project timelines and costs. This level of detail can differentiate agencies in a competitive marketplace, making time-tracking tools invaluable for long-term growth.

Seamless Expense Reporting

Expense management often feels like a necessary but tedious chore, fraught with manual entries and lengthy approval processes. Workflow automation simplifies this dramatically, allowing employees to submit expenses with ease and managers to approve them quickly.

Automated expense reporting provides the following benefits:

- Simplified Submission: Employees can upload receipts and categorize expenses instantly.

- Faster Approvals: Automated workflows route reports to the appropriate approvers without unnecessary delays.

- Enhanced Visibility: Managers gain real-time insights into spending patterns, enabling informed budget decisions.

Consider an agency with frequent travel requirements for client meetings. Automated expense reporting enables team members to snap photos of receipts and submit them on the go. This eliminates paper trails, reduces the time spent on reconciliation, and ensures accurate record-keeping. Agencies maintain tighter control over their budgets while freeing employees to focus on delivering client value.

In addition to improving efficiency, automated expense tools also provide critical data for financial forecasting. By analyzing patterns in expense reports, agencies can identify opportunities for cost-saving measures and optimize resource allocation. This proactive approach can have a significant impact on profitability, ensuring every dollar spent contributes to the agency’s strategic goals.

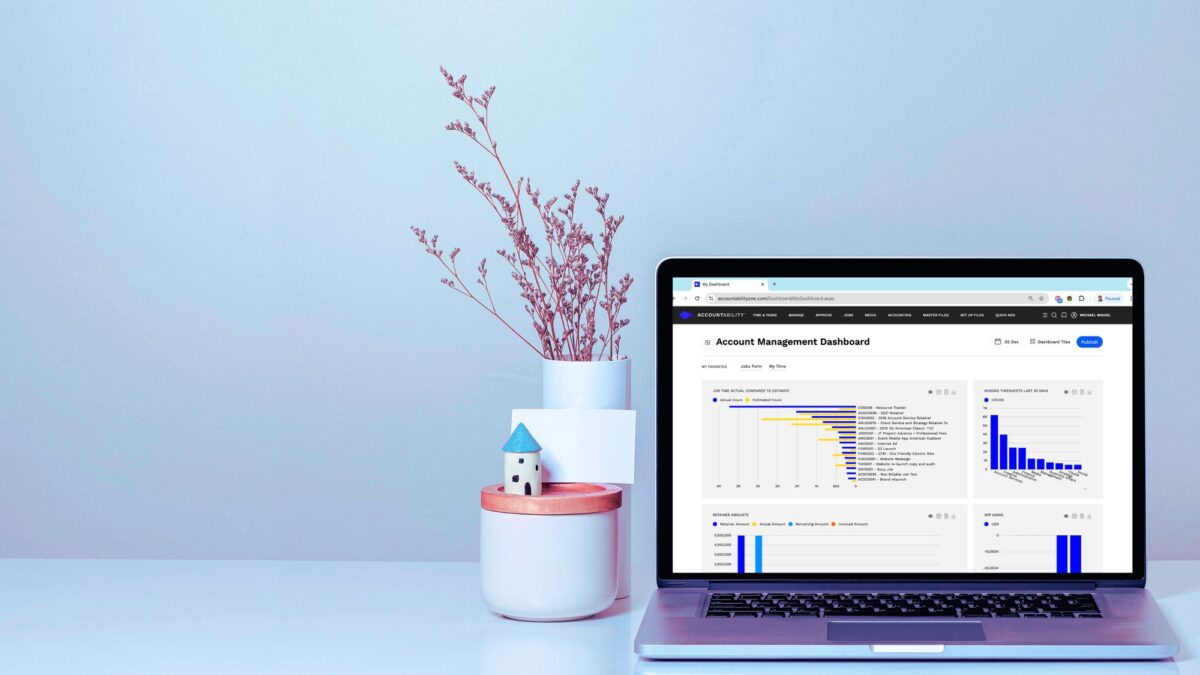

Integrated Job Management

Effective project oversight is essential for delivering quality results on time and within budget. Accountability’s integrated job management features provide real-time insights into project status, resource allocation, and team performance. This holistic approach ensures seamless handling of multiple projects.

The advantages of integrated job management include:

- Centralized Dashboard: A single hub for all project-related information allows for easy tracking and updates.

- Resource Allocation: Managers can view team availability and assign tasks efficiently, optimizing productivity.

- Performance Metrics: Real-time data highlights bottlenecks and areas for improvement, enabling proactive management.

Imagine an agency managing several client campaigns simultaneously. Integrated job management offers clarity on which tasks are on schedule and which require immediate attention. Managers can make informed decisions and intervene when necessary, ensuring deadlines are met without sacrificing quality. Additionally, analyzing performance metrics promotes a culture of continuous improvement, enabling teams to refine their processes for future projects.

Beyond managing current projects, job management automation can also assist in long-term planning. With historical data readily available, agencies can forecast resource needs, set realistic timelines, and anticipate potential challenges. This level of foresight ensures that agencies are always prepared to meet client demands, even as workloads fluctuate.

The Role of Collaboration Tools in Workflow Automation

Automation doesn’t exist in isolation and works best when paired with collaborative tools that foster communication and teamwork. Integration capabilities allow platforms like Accountability to seamlessly connect with popular collaboration and AI tools, creating a unified ecosystem where information flows effortlessly.

For example, automated job management becomes even more powerful when paired with AI-driven task prioritization tools. Teams can focus on high-impact activities while automation handles repetitive scheduling and task updates. This synergy boosts productivity and ensures that everyone remains aligned on project goals and deadlines.

Embrace the Future of Efficiency with Workflow Automation

In a world where disconnected tools can drain productivity, workflow automation emerges as a game-changer for agencies. By harnessing automated time tracking, seamless expense reporting, and integrated job management, teams can work smarter, not harder. These tools don’t just streamline processes—they empower agencies to focus on what truly matters: delivering exceptional results for clients.

Reflect on the insights shared and consider how implementing these automation strategies can transform your workflow. Don’t let inefficiencies hold your agency back. Embrace workflow automation today and transform your operations. Request a free demo and discover how Accountability can redefine your success.