Imagine a world where creativity flows freely, unburdened by the weight of financial ambiguity. Clear financial insights serve as the guiding light for creative teams, illuminating the path to innovation. When teams understand their budgets and profitability, they can focus on what truly matters: crafting remarkable ideas that resonate with clients and audiences alike. By leveraging cutting-edge finance software, creative teams can achieve this level of clarity and drive innovation like never before.

How Finance Software Helps Enable Creative Freedom

The relationship between creativity and financial management often seems at odds, yet the right finance software can harmonize these two elements. By leveraging financial clarity, creative teams can overcome traditional barriers and focus on innovation. Accountability’s features support this harmony, enabling teams to align their vision with financial realities and seamlessly integrate with essential tools.

1) Real-Time Job Budget Tracking

Effective creative work demands precision, especially when it comes to managing budgets. Real-time job budget tracking allows teams to monitor their spending as it happens, ensuring projects remain financially on track while maintaining high-quality standards. This capability offers immediate visibility into financial performance, empowering teams to adapt as necessary.

When a project approaches its budget limit, teams can quickly identify areas to streamline costs without compromising quality. This agility not only ensures financial stability but also enhances collaboration. By keeping everyone informed about budget status, teams can operate with a shared understanding of financial constraints, fostering stronger communication and decision-making. The result is a seamless integration of creativity and fiscal responsibility, made possible by robust finance software.

2) Transparent Client Profitability Reports

Understanding client profitability is key to sustaining long-term success. Transparent profitability reports provide invaluable insights into which clients and projects contribute most significantly to an agency’s financial health. These reports enable teams to make informed decisions about resource allocation and prioritize efforts on high-value opportunities.

Financial clarity in client relationships transforms how teams approach project planning and execution. By identifying the clients that yield the highest returns, teams can channel their energy into projects that align with strategic goals. This clarity supports effective forecasting and strategic planning, ensuring future initiatives are both creative and financially viable. Additionally, clear profitability reports build trust with clients, as agencies can demonstrate the value they bring in concrete terms, solidifying long-term partnerships. The ability to generate such reports is a hallmark of powerful finance software.

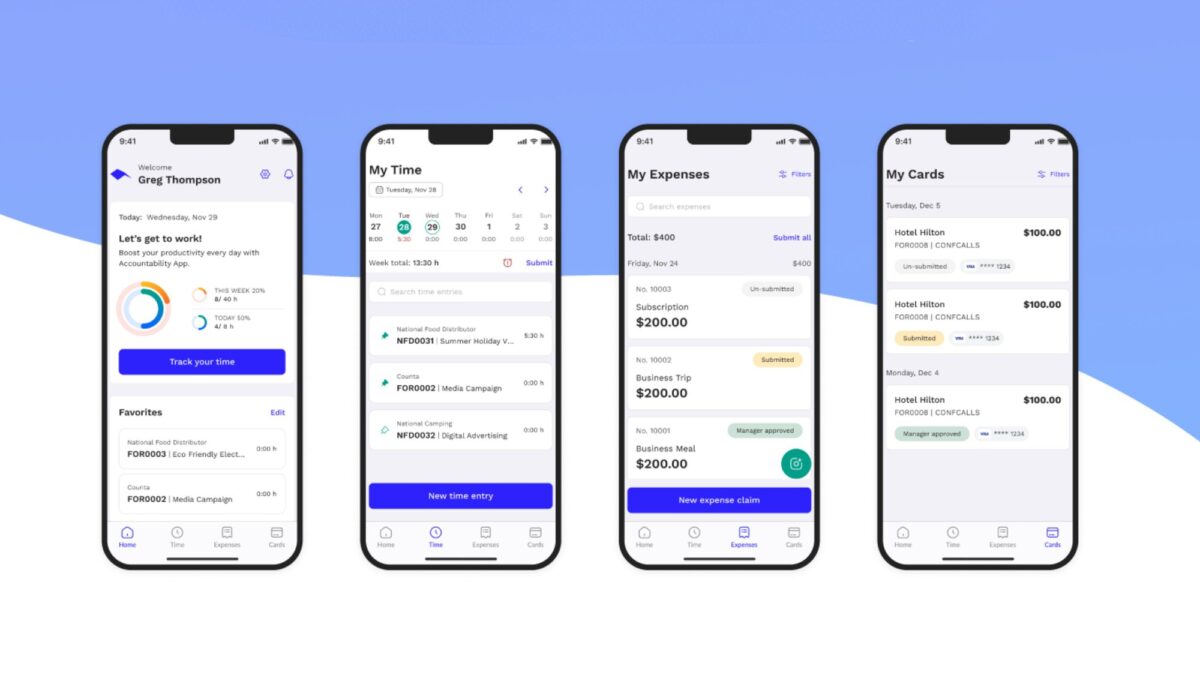

3) Automated Expense Tracking

Managing expenses manually is time-consuming and prone to errors, diverting valuable resources away from creative endeavors. Automated expense tracking addresses this challenge by streamlining the collection and categorization of expenses. By automating these processes, teams save time and minimize the risk of inaccuracies, allowing them to focus on delivering exceptional work.

Automation improves efficiency and enhances transparency within teams. With real-time expense data readily available, teams can monitor spending patterns and adjust strategies to align with project goals. This comprehensive approach ensures that every dollar spent contributes meaningfully to the creative process, creating a balance between financial discipline and imaginative freedom. By incorporating advanced finance software, teams can elevate their operational efficiency.

4) Clear Allocation of Resources

Resource allocation plays a pivotal role in maximizing creativity and productivity. When teams have a clear understanding of their available resources, they can make strategic decisions that optimize project outcomes. This clarity ensures that each project receives the attention and support it deserves, fostering a culture of efficiency and innovation.

Resource clarity enables teams to align their talent and tools with the demands of each project. By prioritizing efforts based on potential impact and profitability, teams can maintain a consistent focus on high-value initiatives. Furthermore, understanding individual strengths and availability allows for precise task delegation, ensuring optimal utilization of talent. With these measures in place, creative teams can avoid burnout while achieving exceptional results. Finance software empowers teams with the insights needed to make these decisions effectively.

5) Customizable Dashboards for Creative Teams

Customizable dashboards provide an intuitive way for teams to access and interpret their financial data. Tailored to highlight the metrics that matter most, these dashboards serve as a powerful tool for enhancing efficiency and alignment. By offering personalized views of key performance indicators (KPIs), dashboards ensure that everyone has access to relevant information at a glance.

Dashboards bridge the gap between data and decision-making, offering visual clarity that empowers teams to act quickly and confidently. Teams can tailor their dashboards to focus on project-specific goals, tracking progress in real time. This unified perspective enhances communication, ensuring that every team member is aligned with the broader financial and creative objectives. By combining accessibility with insight, customizable dashboards transform how teams engage with their financial data, further demonstrating the value of sophisticated finance software.

Fuel Creative Brilliance with Finance Software

Creativity thrives in an environment where uncertainty is minimized, and financial clarity is the foundation that makes this possible. By embracing tools and processes like real-time job budget tracking, transparent profitability reports, and automated expense tracking, teams unlock their full potential. Clear resource allocation and customizable dashboards further enhance this ecosystem, enabling teams to operate with confidence and precision.

The intersection of financial insight and creative freedom is where brilliance happens. When teams are equipped with the right finance software to monitor, analyze, and adapt, they can channel their energy into pushing creative boundaries. A culture of financial clarity fosters innovation, empowering teams to tackle challenges and seize opportunities with boldness and precision.

Take Charge of Your Creative Finances with Accountability

Empower your team with the tools to achieve financial clarity and unlock their full creative potential. Accountability provides the insights and support needed to track, analyze, and adapt with ease. Request a free demo today and take the first step toward transforming your creative process.