In the bustling heart of an agency, information is power. But that power is easily lost in a sea of irrelevant data and generic dashboards that fail to cater to individual needs. What if you could give every team member a personalized command center, a single pane of glass showcasing the exact insights they need to excel in their role?

With Accountability, that vision becomes reality. We’ve redefined agency dashboards, creating a dynamic, role-based system that empowers everyone from the CEO to the intern to work smarter, faster, and more strategically. Say goodbye to information overload and hello to a streamlined, efficient workflow.

The Power of Role-Based Dashboards

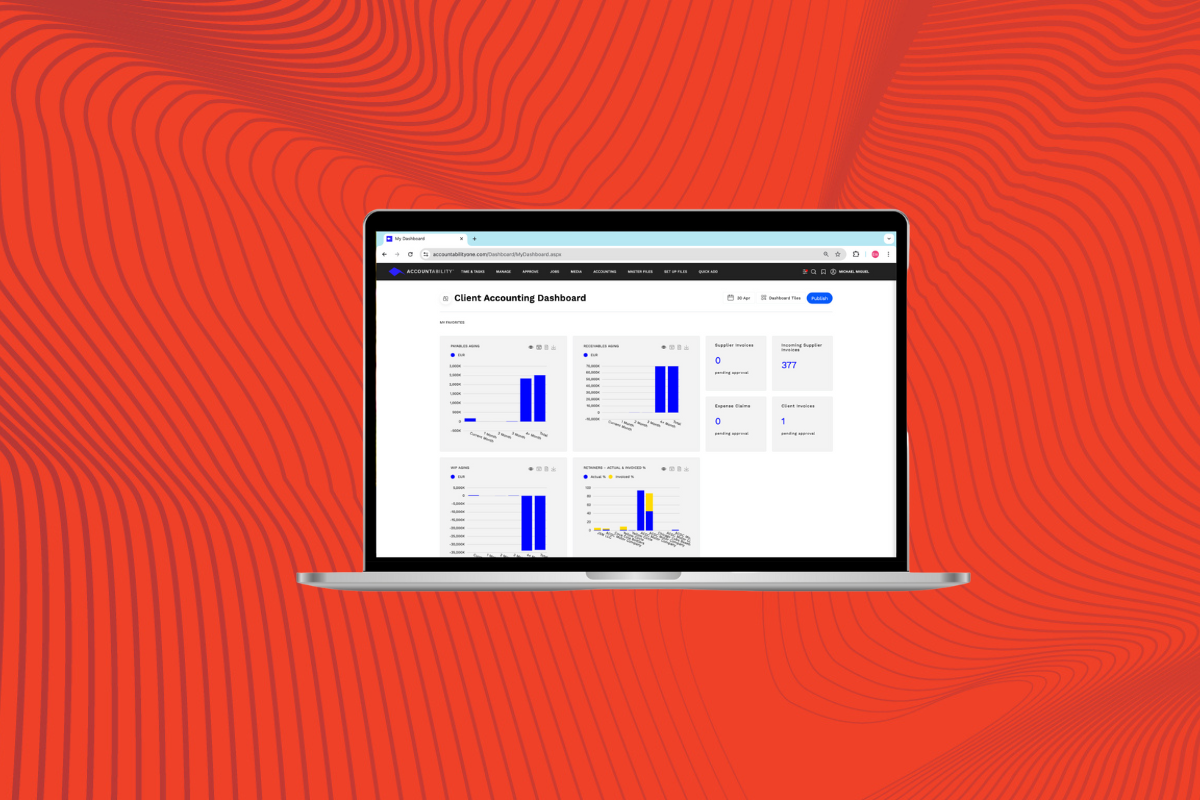

Imagine a dashboard that instantly adapts to your specific role within the agency. No more sifting through irrelevant data or struggling to find the metrics that matter to you. Accountability’s role-based dashboards do just that, tailoring the user experience to individual needs.

How It Works

Accountability’s dashboards are highly configurable. Each role within the agency can be assigned a dashboard template that can be further personalized to meet individual preferences. This ensures that every user sees the information most relevant to their responsibilities, without distractions.

Key Benefits for Every Role:

- CEO/CFO: Get a bird’s-eye view of the agency’s financial health. Track key performance indicators (KPIs) like revenue, profitability, and project performance in real time. Identify trends and make strategic decisions with confidence.

- Account Managers: Monitor project budgets, timelines, and resource allocation. Identify potential bottlenecks or scope creep early on. Ensure projects stay on track and within budget.

- Creative Directors: Track team capacity and utilization. Identify resource gaps or overallocation. Optimize team workflows and ensure projects are staffed effectively.

- Project Managers: Gain real-time visibility into project progress, budgets, and task completion. Keep projects on schedule and within scope. Identify and address potential issues proactively.

- Finance Team: Streamline billing, invoicing, and expense tracking. Generate accurate financial reports with ease. Ensure timely payments and maintain financial transparency.

Beyond the Basics

Accountability’s role-based dashboards go beyond simply displaying data. They also offer powerful features like:

- Drill-down capabilities: Dive deeper into specific metrics to gain granular insights.

- Customizable widgets: Add, remove, or rearrange widgets to create a personalized view.

- Interactive visualizations: Explore data through charts, graphs, and other visual formats.

- Real-time updates: Stay up-to-date with the latest information, ensuring decisions are based on the most current data.

In the fast-paced agency environment, efficiency is key. Accountability’s role-based dashboards empower every team member with the right information at the right time, driving productivity, collaboration, and ultimately, agency success.

Don’t settle for a one-size-fits-all dashboard. Experience the power of personalization with Accountability.