Financial transparency is the foundation of sustainable business growth, turning raw numbers into actionable insights. When agencies have clear visibility into their financial health, they can make strategic decisions with confidence, optimize resource allocation, and build trust with stakeholders. Without this clarity, inefficiencies, unnecessary risks, and lost opportunities can erode profitability and hinder long-term success.

Operating without financial transparency is like navigating a complex landscape without a map. Without clear financial visibility, agencies risk making decisions based on assumptions rather than data. By embracing financial transparency, agencies can align their strategies with real-time insights, proactively addressing challenges and seizing new opportunities. The right financial management tools simplify these processes and empower teams to make informed, data-driven choices that enhance stability and growth.

How Accountability Delivers Financial Transparency

Financial transparency isn’t just about tracking numbers—it’s about creating a system where financial data is accessible, accurate, and actionable. Without clear financial insights, agencies may struggle with inefficient resource allocation, unexpected cash flow issues, and missed growth opportunities. By leveraging technology-driven solutions, agencies can gain real-time visibility into their financial health, ensuring smarter decision-making and long-term sustainability.

The right tools streamline financial processes and empower teams to work more efficiently and strategically. Here’s how a robust financial management system like Accountability enhances transparency across key financial areas:

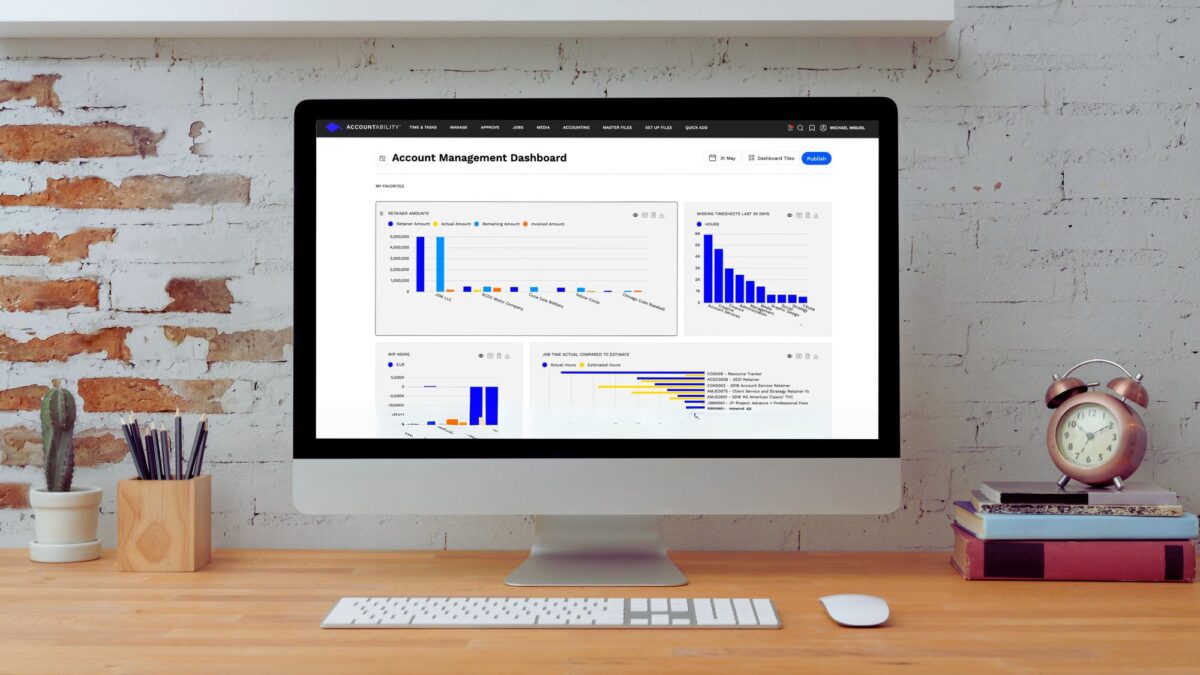

Real-Time Financial Dashboards

In today’s fast-paced environment, real-time financial dashboards provide a vital lens into an agency’s financial health. These dashboards offer an intuitive, visual representation of key financial metrics, allowing decision-makers to assess revenue, expenses, and profitability at a glance.

With real-time insights, agencies can detect emerging trends and adjust their strategies accordingly. For example, if revenue dips unexpectedly, financial teams can identify the root cause—whether it’s project delays, client churn, or unexpected costs—and implement corrective measures immediately. This level of agility ensures that businesses remain proactive rather than reactive, improving financial stability and resilience.

Job-Level Profitability Reports

Profitability can vary significantly across different clients and projects, making it essential to track financial performance at a granular level. Job-level profitability reports break down earnings and expenses associated with each project, helping agencies pinpoint the most lucrative opportunities and identify areas for improvement.

By leveraging these insights, agencies can allocate resources more effectively. If a specific project consistently yields high profit margins, leadership may decide to prioritize similar opportunities. Conversely, low-margin projects may require renegotiation of contracts or adjustments to pricing structures. This level of analysis helps agencies maintain financial efficiency while delivering high-value services.

Accurate Forecasting Tools

Strategic planning depends on accurate financial forecasting. By analyzing historical data and market trends, agencies can create more precise revenue and expense projections, setting realistic growth targets that align with financial realities.

Effective forecasting is particularly beneficial for cash flow management. Anticipating potential revenue fluctuations allows agencies to plan for lean periods, ensuring financial stability even during market downturns. For instance, if forecasts indicate a seasonal dip in client activity, agencies can adjust spending plans, explore new revenue streams, or optimize their service offerings to counteract the slowdown. This proactive approach strengthens resilience and long-term financial health.

Comprehensive Expense Tracking

A deep understanding of expenditures is crucial for optimizing profitability. Expense tracking enables agencies to identify spending patterns, control costs, and eliminate inefficiencies that drain resources.

By categorizing and analyzing expenses, finance teams can detect overspending trends. If travel costs, software subscriptions, or operational expenses are consistently exceeding budgets, adjustments can be made to optimize spending without compromising productivity. Robust expense tracking fosters financial discipline and ensures that every dollar contributes to overall business objectives.

Clear Role-Based Data Access

Financial transparency doesn’t mean unrestricted access to sensitive data—it means ensuring that the right people have the right insights at the right time. Role-based data access allows teams to see the financial information that is relevant to their responsibilities while maintaining security and confidentiality.

For instance, project managers benefit from job-level profitability reports, while finance teams require comprehensive expense-tracking tools. This structured approach empowers employees with the insights they need to make informed decisions while safeguarding sensitive financial data. By fostering accountability at all levels, agencies can cultivate a culture of financial responsibility and strategic execution.

Embracing Financial Clarity for Sustainable Growth

Financial transparency is more than just a best practice—it’s a strategic advantage. Agencies that prioritize real-time financial dashboards, profitability reports, accurate forecasting, and meticulous expense tracking position themselves for long-term success. These tools provide the clarity needed to optimize operations, improve decision-making, and foster sustainable growth.

By integrating role-based data access and leveraging advanced financial management solutions, agencies can enhance financial oversight, reduce risks, and strengthen their competitive edge. Now is the time to take control of financial complexity and transform transparency into a driving force for growth.

Request a free demo to see how Accountability can help your agency achieve financial clarity and efficiency.