ERP horror stories usually end with one phrase:

“They got us live—and then disappeared.”

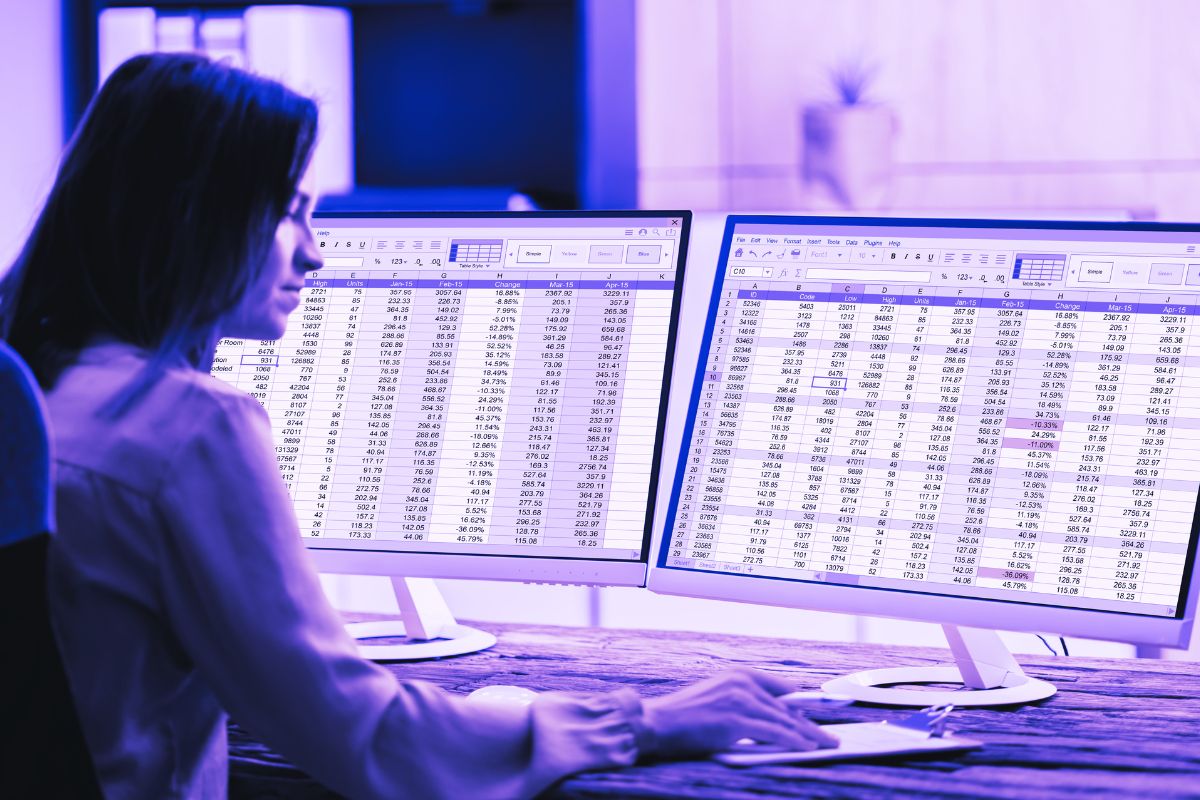

If you’ve been through a traditional software rollout, you probably know the routine:

- The onboarding team is great… until week 12.

- The support handoff is vague at best.

- Your team starts asking, “Are we supposed to figure this out ourselves now?”

We’ve heard these stories. That’s why we built our implementation and support model differently.

We don’t vanish at go-live. In fact, we’re just getting started.

Growth Isn’t the Finish Line—It’s the First Step

You didn’t invest in a modern financial platform to solve a single problem. You invested because your agency is evolving:

- Growing client portfolios

- Expanding into new markets

- Navigating more complex billing models

- Scaling operations across teams and geographies

The systems you rely on need to keep pace. And so do the people behind them.

Our Hands-On Support Model: What It Really Looks Like

Here’s how we stay involved long after the onboarding champagne is gone:

1. A Customer Success Team That Knows Your Business

Our Customer Success team isn’t just a support inbox.

They’re proactive, strategic partners who:

- Know how your agency works

- Understand your growth goals

- Anticipate needs before they become issues

You’re not explaining your business every time you have a question. You’re talking to someone who already gets it.

2. Strategic Check-Ins, Not Just Ticket Replies

Post-launch support shouldn’t be reactive.

We schedule regular reviews to look at:

- Platform performance

- New workflow needs

- Feature adoption

- Opportunities to optimize based on how your agency is evolving

Think of it as ongoing calibration, not crisis control.

3. Guidance Through Growth Phases

As your agency grows, your needs will shift.

- Adding new entities? We’ll help you structure for global scale.

- Changing billing models? We’ll guide your team through it.

- Expanding reporting requirements? We’ll help you build dashboards that flex.

We don’t just answer questions. We help you grow smarter.

4. Continuous Feature Education (Without the Overwhelm)

New features and updates are only valuable if your team knows how to use them. We offer:

- Targeted updates when functionality matches your needs

- Walkthroughs tailored to your workflows

- Best practices drawn from our agency client network

No overwhelming product dumps. Just the tools you need, when you need them.

We Scale With You—Not Away From You

The truth is, software alone doesn’t solve problems.

Software + strategy + support = long-term success.

We stay close so that:

- You never feel abandoned post-launch

- You have a direct line to people who understand your context

- You can adapt quickly as your agency grows

Because sustainable growth doesn’t happen with tools alone. It happens with partnership.

Already thinking past go-live? Good. So are we.

See how our financial platform—and our people—support your agency through every stage of growth.