Managing time and expenses effectively is crucial for agencies looking to optimize resources, enhance productivity, and track every project detail. With agency efficiency software, teams can streamline financial processes, track time and expenses from any location, and gain real-time insights. These tools empower agency professionals to stay aligned with project goals, make data-driven decisions, and maintain cost control with ease.

Features of Accountability’s Mobile Time and Expense App

Tracking time and expenses in real time is essential for accurate billing, budgeting, and project oversight. Accountability’s mobile app, a comprehensive agency efficiency software, offers practical tools to ensure professionals can log time and manage expenses with precision.

Instant Time and Expense Tracking

The Accountability mobile app enables users to log hours and expenses on the go, ensuring that every task is accounted for as it happens. This feature allows agency professionals to avoid the common pitfalls of forgetting or inaccurately estimating time, resulting in more accurate billing and detailed project insights. The app’s real-time entry system captures every moment worked, providing agencies with a precise overview of project costs.

With the ability to track time instantly, agency teams gain a real-time view of project progress. This visibility supports proactive budget management and helps align work with client expectations, enhancing overall efficiency.

Effortless Integration with Accountability's Platform

The Accountability mobile app syncs directly with its comprehensive financial platform, ensuring critical data flows seamlessly between time tracking and expense management tools. This minimizes manual input errors, reduces administrative burden, and keeps data accurate and up-to-date, saving professionals valuable time.

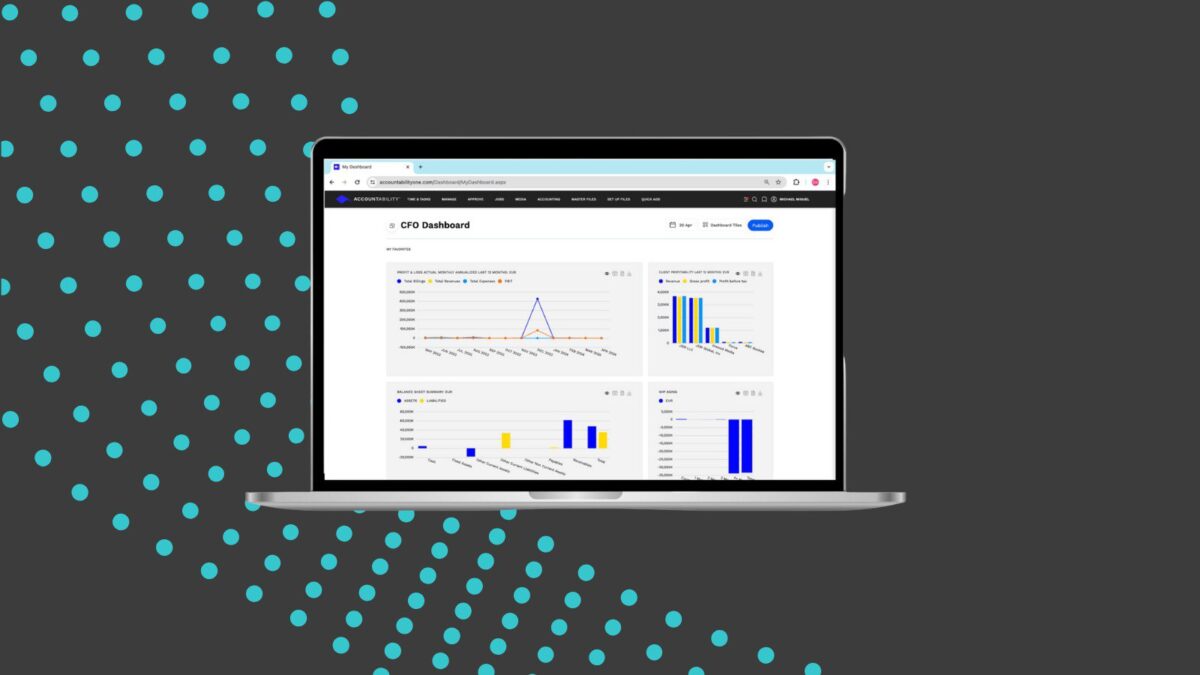

Real-time synchronization allows managers to see time and expense data instantly reflected on the financial dashboard. This immediate visibility empowers them to monitor project performance, make informed budgetary adjustments, and optimize resources swiftly. For agencies juggling complex budgets across multiple clients, this integrated approach delivers the insights needed for smarter, data-driven decision-making and sustained profitability.

Benefits for Agency Professionals

Effective time and expense tracking brings numerous advantages for agencies, particularly those managing multiple projects. Agency efficiency software helps streamline these tasks, enabling professionals to stay focused on their primary responsibilities without being bogged down by administrative burdens.

Increased Accuracy in Time Tracking

For agency professionals working across multiple projects, accurate time tracking is essential. Accountability’s mobile app eliminates the need for retrospective time entry by allowing on-the-go logging. This feature supports real-time accuracy, leading to more precise billing and better oversight of resources.

Real-time tracking provides professionals with a detailed understanding of how time is spent across tasks, making it easier to meet budget targets and maintain productivity. With reliable time records, agencies can improve resource management and ensure that client billing reflects the actual time dedicated to each project.

Optimized Project Costs

The ability to track time and expenses in real time provides agencies with a holistic view of project costs, helping them allocate resources effectively. As a feature of agency efficiency software, this capability enables professionals to monitor each project’s financial trajectory, allowing for informed adjustments to budgets and resources as necessary.

For example, a marketing agency managing a campaign can identify if certain components are consuming more resources than anticipated. Catching these trends early helps teams shift resources as needed to optimize project costs, ensuring projects remain profitable without compromising quality.

Reduced Administrative Workload, Anywhere You Go

Traditional time and expense tracking can be a significant drain on resources, especially when relying on manual data entry and weekly reconciliations. Accountability’s mobile app is designed for professionals on the move, automating these tasks and freeing up valuable time. Whether at a client meeting, in transit or working remotely, users can effortlessly log time and expenses in real time, reducing repetitive data entry and administrative stress.

With real-time data capture, up-to-date reports are always at your fingertips. This means managers can access crucial information and generate reports whenever and wherever they need, enabling swift decision-making and strategic adjustments. By streamlining the workflow through automation, Accountability’s app empowers agencies to maintain efficiency and precision, all while keeping teams focused on their core work.

Enhanced Efficiency for Professionals on the Move

Accountability’s mobile app is designed to simplify time and expense management for busy professionals. By enabling real-time entry and tracking, the app ensures that accurate data is always available without the need for manual reconciliations or end-of-week updates. This streamlined approach helps individuals stay focused on their core responsibilities while minimizing administrative workload.

For managers, the app provides immediate access to up-to-date data, enabling them to make informed decisions and provide feedback as needed. This on-the-go capability supports efficient project management and helps maintain momentum, even in remote or hybrid work environments. The result is improved operational efficiency and timely project oversight that keeps teams productive and on track.

Unlocking Efficiency with Accountability’s Mobile App

The Accountability mobile app offers agency professionals a streamlined approach to managing time and expenses. By providing tools for accurate tracking and cost optimization, this agency efficiency software helps teams make informed decisions that boost productivity and improve project outcomes.

Ready to experience the benefits firsthand? Request a free demo here and discover how streamlined workflows can boost your agency’s productivity and financial control.