The future of advertising and marketing agencies is poised for transformative change, driven by several key factors that include technological advancements, shifting consumer behaviors, and evolving business models. As we look towards the near future, several predictions can be made about the changes likely to occur within this dynamic industry.

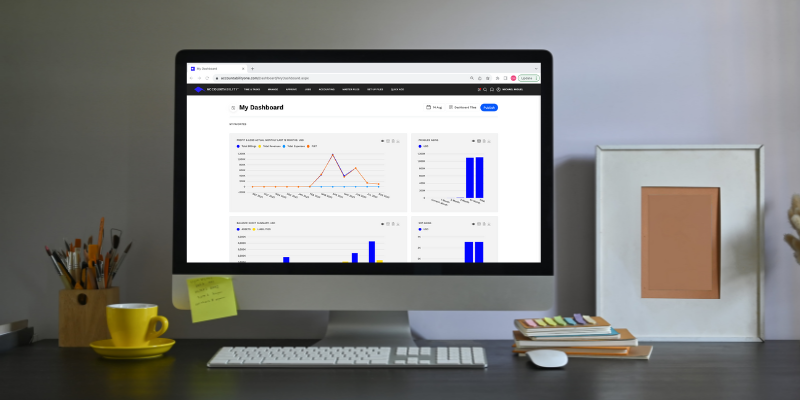

1. Increased Emphasis on Data and Analytics

The role of data and analytics in advertising and marketing is set to become even more central. Agencies will invest heavily in advanced data analytics tools and platforms to gain deeper insights into consumer behaviors, preferences, and trends. This shift will enable more personalized and targeted advertising strategies, moving beyond broad demographic targeting to more nuanced and individualized approaches.

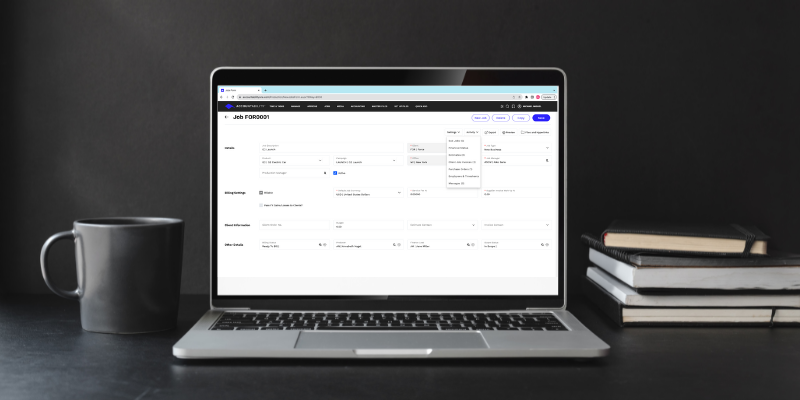

2. Integration of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) technologies will continue to reshape the advertising and marketing landscape. From automating routine tasks to generating insights from large datasets, these technologies offer significant efficiencies and capabilities. We can expect to see AI-driven content creation, predictive analytics for trend forecasting, and intelligent automation of customer interactions, enhancing both creativity and efficiency in campaigns.

3. The Rise of Augmented Reality (AR) and Virtual Reality (VR)

AR and VR technologies are set to create immersive and interactive advertising experiences. As these technologies become more accessible, agencies will innovate in how they engage consumers, offering virtual product experiences, interactive brand stories, and enhanced digital environments. This will open new avenues for creative storytelling and experiential marketing.

4. Focus on Sustainability and Ethical Marketing

Consumer awareness and concern about environmental and social issues are growing. In response, advertising and marketing agencies will need to prioritize sustainability and ethical practices both in their operations and in the campaigns they create. This includes promoting sustainable products, using eco-friendly materials and methods, and ensuring transparency and authenticity in marketing messages.

5. Evolving Consumer Privacy Regulations

With increasing concerns over data privacy, advertising and marketing practices will need to adapt to stricter regulations. Agencies will have to navigate the complex landscape of global data protection laws, ensuring compliance while still delivering effective marketing strategies. This may lead to greater use of first-party data and development of privacy-centric marketing technologies.

The future of advertising and marketing agencies is one of rapid evolution and opportunity. By embracing technological advancements, prioritizing ethical practices, and adapting to changing consumer expectations, agencies can thrive in this new landscape. Success will depend on their ability to innovate, personalize, and create meaningful connections between brands and their audiences.